Steel construction prices have been steadily rising for a while now, with most of the specialists in the field expecting slow, but steady growth over the entirety of 2022. However, with the appearance of the Russia-Ukraine conflict in late February, a lot of industries have been experiencing (or expecting) drastic price changes – steel construction industry included.

The steel prices per tonne have managed to rise as high as 22% in the first week of the conflict (up to €1,160 or $1,257), and the latest news about expected import bans from Russia several days ago managed to bring the price of steel per tonne up to €1,435 (or $1,583), with both pricings being provided by Kallanish Commodities Ltd.

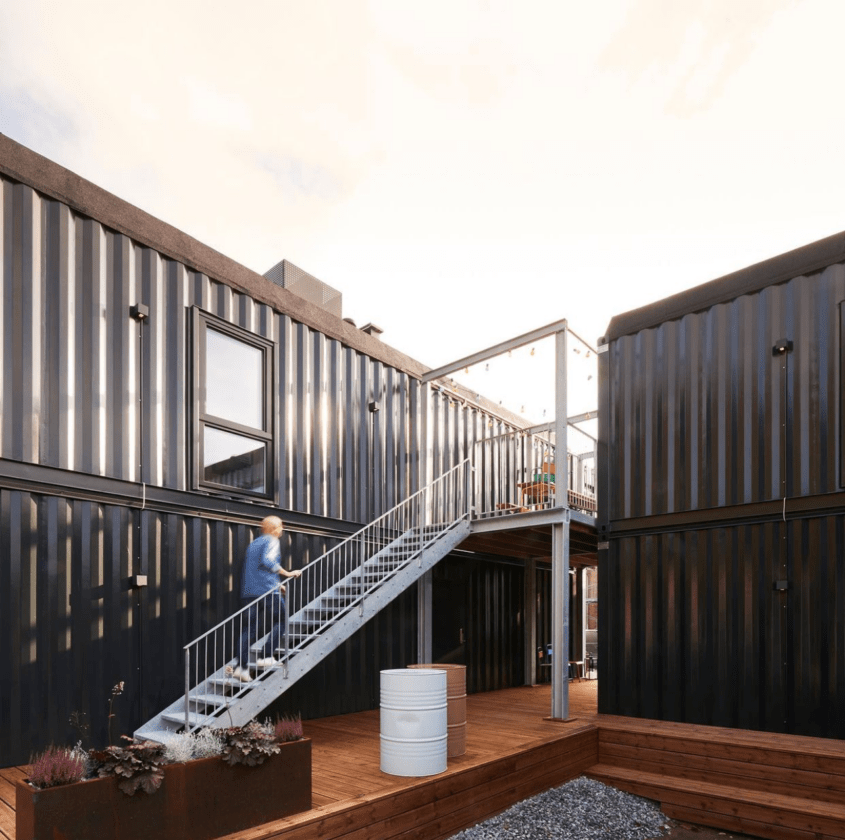

As such, the price for more specific steel materials have gone up, as well. There are three main types of steel blanks – steel profiles, steel pipes and steel sheets. All three of these now experience a massive price surge, with the average Europe prices right now being as follows:

- Steel profile – €1,550 to €2,000 per tonne;

- Steel pipes – €1,800 to €2,190 per tonne;

- Steel sheet – €2,300 to €3,500 per tonne.

While the actions in question are performed with the intent of pressuring Russia into ceasing the conflict, it is also fair to say that the European Union would also suffer the consequences of massive price increases, since the EU is a big market for Russian steelmakers as a whole.

Multiple different steel producers in Ukraine have been forced to pause their operations due to the ongoing war, creating an even bigger problem of meeting steel demand for the market (with both Russia and Ukraine being some of the top steel exporters in the world). A lot of Russian steel producers have also been facing issues with export, with most of them being sanctioned and not having the ability to export to the EU.

All of this information only concerns steel – but it is also not the only resource that faces supply issues and price surges. Since both Russia and Ukraine are contributing quite a lot to multiple markets in terms of metals and other resources, it is only logical that the market prices would soar when these countries are either incapable or restricted from exporting those materials.

According to Reuters, there are quite a lot of markets that both Ukraine and Russia would continue to influence if the conflict goes on. For example, Russia’s Rusal is the second biggest aluminum producer in the world, accounting for as much as 6% of the world production in the entirety of 2021. A similar situation is applied to copper (3.5%), nickel (7%), palladium (40%) and platinum (10%). There’s also the titanium production, with both Russia and Ukraine combined accounting for over 15% of the world production.

Sanctions, logistical issues, as well as the ongoing war – these are just some of the reasons why so many industries are affected by the ongoing Russia-Ukraine conflict. However, it would be also unfair to say that the prices only rose because of the war.

Even before February 24th, 2022, steel construction prices have been steadily rising for a number of different reasons. According to Gordian’s Construction Cost Database, there are four such reasons:

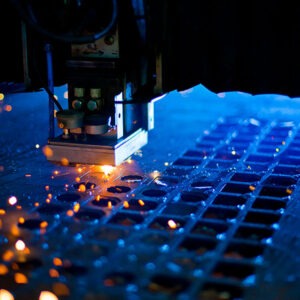

Steel fabrication costs might be the biggest contributor for this situation as a whole, being influenced by two factors – energy prices and wage rates. With wage rates steadily rising in most countries, and steel fabrication requiring a massive amount of energy to perform in the first place – it is not that surprising to see steel fabrication costs rise on a regular basis.

Supply and demand is also a major factor, with COVID-19 pandemic hitting more or less every industry on the planet – especially for industries like steel construction, with little to no way of remote working. Production delays and job losses have delivered a rather intense hit to the industry as a whole, and now businesses trying to ramp up operations to try and recover from it have left a lot of supply chains in a near-empty state, with prices at all time highs months before the war started.

Installation labor is another field affected by wages, since the process of generating steel constructions is heavily dependent on the competent workforce (same as with fabrication). At the same time, the pandemic has inevitably created a somewhat noticeable labor shortage, meaning that a lot of companies and employers would be forced to pay extra to keep their personnel in place – and this also raises the overall steel construction prices.

Transportation costs are also a rather important factor here, with both driver wages and fuel/maintenance/insurance costs going up each year. The influence of tariffs and other taxes is working the same way, inevitably increasing the overall steel construction costs.

As you can see, there were multiple factors of steel construction prices rising for a while now – the problem of steel construction prices rising has always been on the horizon, and the start of a war between two of the biggest material providers only deepened the extent of the problem for the industry as a whole.